Are you facing penalties for early withdrawals from your retirement account, excess contributions, or missed required minimum distributions? Don’t worry, the IRS has provided a solution in the form of IRS Form 5329. In this comprehensive guide, we will walk you through the basics of IRS Form 5329, explain the different types of penalty relief it addresses, and provide expert tips and guidance on how to fill out the form to obtain forgiveness for your tax liabilities. Whether you’re an individual taxpayer seeking relief or a tax professional assisting clients, this guide will equip you with the knowledge and tools to navigate the IRS forgiveness process effectively. Say goodbye to penalties and hello to peace of mind by utilizing IRS Form 5329 to its fullest potential.

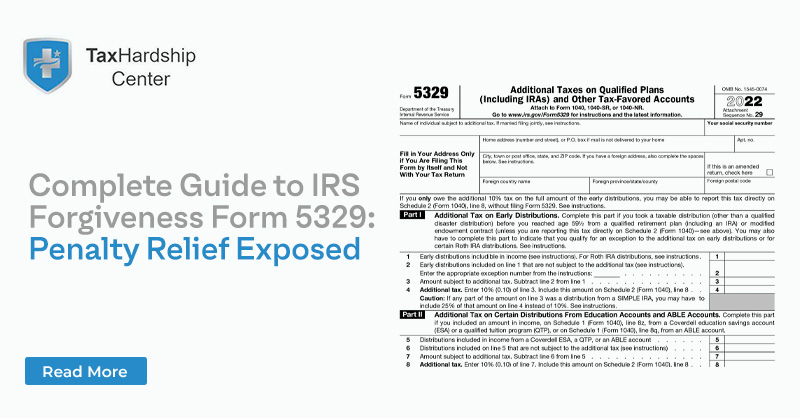

What is IRS Form 5329?

IRS Form 5329 is a document provided by the Internal Revenue Service (IRS) that allows taxpayers to report and request penalty relief for certain types of tax liabilities. This form is specifically designed to address penalties related to early distributions from retirement accounts, excess contributions to retirement accounts, and other similar tax-related issues.

Basics of IRS Form 5329

IRS Form 5329 serves as a way for taxpayers to disclose any penalties they may have incurred and request forgiveness for those penalties. The form consists of sections, each addressing a specific type of penalty relief. It is essential to carefully read and understand the instructions provided with the form before filling it out.

Types of Penalty Relief Addressed by IRS Form 5329

IRS Form 5329 provides relief for penalties related to early distributions from retirement accounts, excess contributions to retirement accounts, and missed required minimum distributions.

- Early Distributions from Retirement Accounts:

One of the primary purposes of IRS Form 5329 is to address penalties for early withdrawals from retirement accounts. Generally, individuals who withdraw money from their retirement accounts before reaching the age of 59 ½ are subject to an early withdrawal penalty. However, certain exceptions may qualify for penalty relief, such as disability or using funds for higher education expenses.

- Excess Contributions to Retirement Accounts:

If you have made contributions to your retirement account exceeding the allowed limits, you may be penalized. Form 5329 provides a section where you can report these excess contributions and request penalty relief if you meet specific criteria.

- Required Minimum Distributions:

Individuals who reach the age of 72 (previously 70 ½ before the SECURE Act) are required to start taking distributions from their retirement accounts. Failing to take these distributions on time may result in penalties. IRS Form 5329 includes a section where you can report missed or underreported distributions and request penalty relief.

How to Fill Out IRS Form 5329

- Obtain the Form: IRS Form 5329 is available on the official website of the IRS. You can download and print the form from there.

- Provide Personal Information: Begin by filling out your personal information, including your name, Social Security Number, and address.

- Specify the Type of Penalty Relief: Indicate the specific type of penalty relief you seek, such as early distributions, excess contributions, or missed distributions.

- Calculate the Penalties: Use the instructions provided with the form to calculate the penalties you are requesting relief for. This may involve determining the taxable portion of the distributions or calculating the excess contributions that need to be reported.

- Attach Supporting Documentation: Depending on the type of penalty relief you seek, you may be required to attach supporting documentation to substantiate your claim. This could include forms from your retirement account provider or proof of higher education expenses.

- Sign and Date the Form: Once you have completed all the necessary sections, sign and date the form before submitting it to the IRS.

In conclusion, IRS Form 5329 is valuable for taxpayers seeking penalty relief for early distributions, excess contributions, and missed required minimum distributions. By understanding the basics of this form and following the proper steps to fill it out, you can avoid or reduce the financial burden of penalties imposed by the IRS.

Remember, seeking professional advice and thoroughly reviewing the instructions provided with Form 5329 can significantly enhance your chances of obtaining penalty relief. Whether you’re an individual taxpayer or a tax professional, staying informed and knowledgeable about the IRS forgiveness process is crucial.

So, if you find yourself in a situation where penalties loom over your head, don’t panic. Take advantage of the forgiveness options the IRS provides and utilize IRS Form 5329 to navigate toward penalty relief.

Take action today and download IRS Form 5329 from the official IRS website. By filling out the form accurately and providing the necessary documentation, you can alleviate the financial stress caused by tax penalties and enjoy the peace of mind that comes with achieving forgiveness for your tax liabilities. Don’t let penalties hold you back – seize the opportunity for relief with IRS Form 5329!

Questions? Click below to get expert tax advice.

FAQ about IRS Form 5329

FAQ 1: Can I request penalty relief for multiple types of penalties on one form?

Yes, you can request relief for multiple penalties on one IRS Form 5329. Simply complete the relevant sections that apply to your situation.