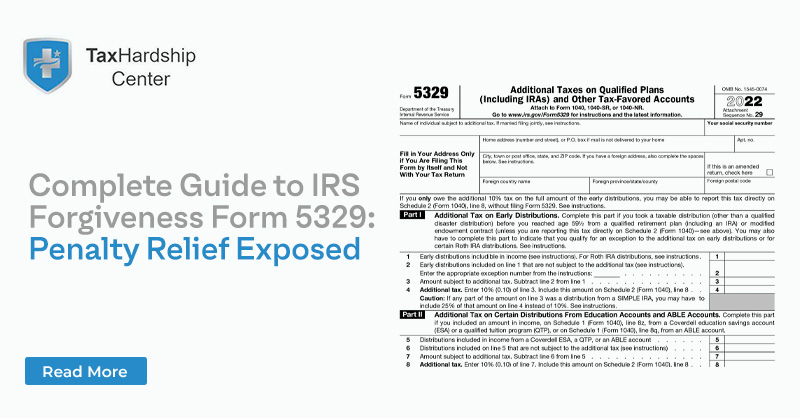

Complete Guide to IRS Forgiveness Form 5329: Penalty Relief Exposed

Are you facing penalties for early withdrawals from your retirement account, excess contributions, or missed required minimum distributions? Don’t worry, the IRS has provided a solution in the form of IRS Form 5329. In this comprehensive guide, we will walk you through the basics of IRS Form 5329, explain the different types of penalty relief […]

Complete Guide to IRS Forgiveness Form 5329: Penalty Relief Exposed Read More »